As the cryptocurrency landscape continues to evolve in 2025, Bitcoin mining remains one of the most dynamic and competitive sectors in the digital economy. With Bitcoin’s block reward halving events and increasing network difficulty, miners are compelled to invest in the most advanced and efficient mining rigs to maintain profitability. The choice of mining machines is not a mere technical decision; it directly impacts returns, operational costs, and the scalability of mining operations. Companies specializing in selling and hosting mining machines need to offer solutions that balance raw computational power with energy efficiency, ensuring optimal returns for miners amidst fluctuating market prices.

Bitcoin’s mining process relies on complex cryptographic puzzles that demand immense computational power — measured in terahashes per second (TH/s). The rise in network difficulty means older mining rigs quickly become obsolete unless paired with subsidized electricity or hosted in regions with ultra-low power costs. Today’s leading miners are switching to state-of-the-art ASIC (Application-Specific Integrated Circuit) devices specifically optimized for the SHA-256 algorithm underpinning Bitcoin. Machines like the Antminer S19 XP and Whatsminer M50S, for example, offer hashrates exceeding 100 TH/s while maintaining electricity consumption around or below 3000W, striking an ideal balance between hash power and energy use.

Beyond Bitcoin, other cryptocurrencies such as Dogecoin (DOGE) and Ethereum (ETH) present diversified mining opportunities, though with distinctive requirements. Dogecoin, built upon a Scrypt algorithm similar to Litecoin, typically favors FPGA and GPU rigs, though specialized ASICs are gaining traction. Meanwhile, Ethereum mining, centered on the Ethash algorithm, has been predominantly driven by high-end GPUs—until the Ethereum network’s transition to proof-of-stake shifted the landscape drastically. Yet, the hosting of mining rigs for alternatives like Ethereum Classic and decentralized finance tokens maintains relevance. Mining farms that offer hosting services now frequently provide tailored solutions catering not only to Bitcoin miners but also to multi-currency miners who leverage flexible infrastructure for diverse asset exposure.

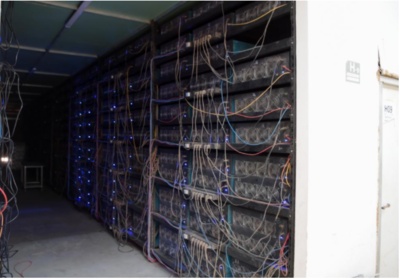

Hosting mining machines is a compelling service that significantly enhances operational efficiency. Mining farms with large-scale, environmentally optimized facilities manage the complexities of cooling, energy sourcing, and maintenance, thereby reducing downtime and maximizing uptime. For investors and hobbyists unable or unwilling to maintain physical machines, hosting services become a lucrative option. These services often include remote monitoring, automatic firmware updates, and advanced performance analytics to ensure constant profitability. With increasingly volatile cryptocurrency prices impacting mining returns, hosted miners benefit from professional facilities that can adapt swiftly to changing economic conditions, whether by optimizing hash rates or switching between cryptocurrencies based on market trends.

The integration of mining machines with exchanges represents another layer of the crypto ecosystem that amplifies liquidity and access. Miners, especially large-scale operations, actively convert mined coins on exchanges to manage capital and reinvest into hardware upgrades or expand hosting capabilities. Some exchanges even offer mining pools directly linked to user accounts, streamlining the reward payout and reinvestment processes. This symbiosis between mining hardware, hosting farms, and crypto exchanges underscores the contemporary mining ecosystem’s interconnectedness. It also means that miners must be increasingly savvy in understanding not just the technical specifications of their miners but also market dynamics, transaction fees, and liquidity strategies.

Looking ahead, technological innovations forecast an evolution in mining hardware with an emphasis on quantum resistance, modular designs, and AI-optimized mining strategies. Companies engaged in the sale and hosting of mining machines are focusing on integrating smart analytics and automation—enabling remote tuning of parameters in real-time, predicting hardware failures before they occur, and dynamically allocating hash power between coins. This trend is especially pronounced in Bitcoin mining due to its mature market and capital-intensive nature, but it soon ripples through altcoin mining as well, demanding a versatile and adaptable hardware base.

In summary, the 2025 Bitcoin mining forecast highlights a nuanced synthesis of technology, strategy, and market awareness. Selecting the right mining machines—those that combine power, efficiency, and longevity—serves as the cornerstone of successful operations. Hosting mining services continue to attract a broad spectrum of miners by offloading operational responsibilities while leveraging economies of scale. Meanwhile, the intertwining of mining rigs with broader ecosystems such as exchanges enhances liquidity and financial planning for miners. As blockchain technology matures, the frontline of mining innovation will rest squarely on hardware excellence augmented by smart, flexible hosting solutions designed to seize optimal returns in an ever-shifting crypto market.

One response to “2025 Bitcoin Mining Forecast: Best Machines for Optimal Returns”

2025’s Bitcoin mining forecast spotlights innovative machines like advanced ASICs, promising high returns amid volatile markets. Yet, unexpected energy costs and regulations could flip the script—opt for eco-adaptive rigs to hedge risks and maximize gains.